Last Updated May 10, 2023

Mina is the world’s lightest blockchain. It is a public and decentralized blockchain that is open for anyone in the world to participate in actively or passively. Individuals or companies can help increase the security of the network by becoming nodes or block producers, or they can help lower the cost of transactions by becoming SNARK producers, or they can be both.

The MINA token is the native currency of the Mina blockchain, and is required to participate in block production and purchasing of SNARK proofs, via the Snarketplace.

This post intends to help the Mina community understand how the MINA tokens have been distributed at the launch of Mina’s mainnet in March 2021, and may be distributed thereafter.

Highlights

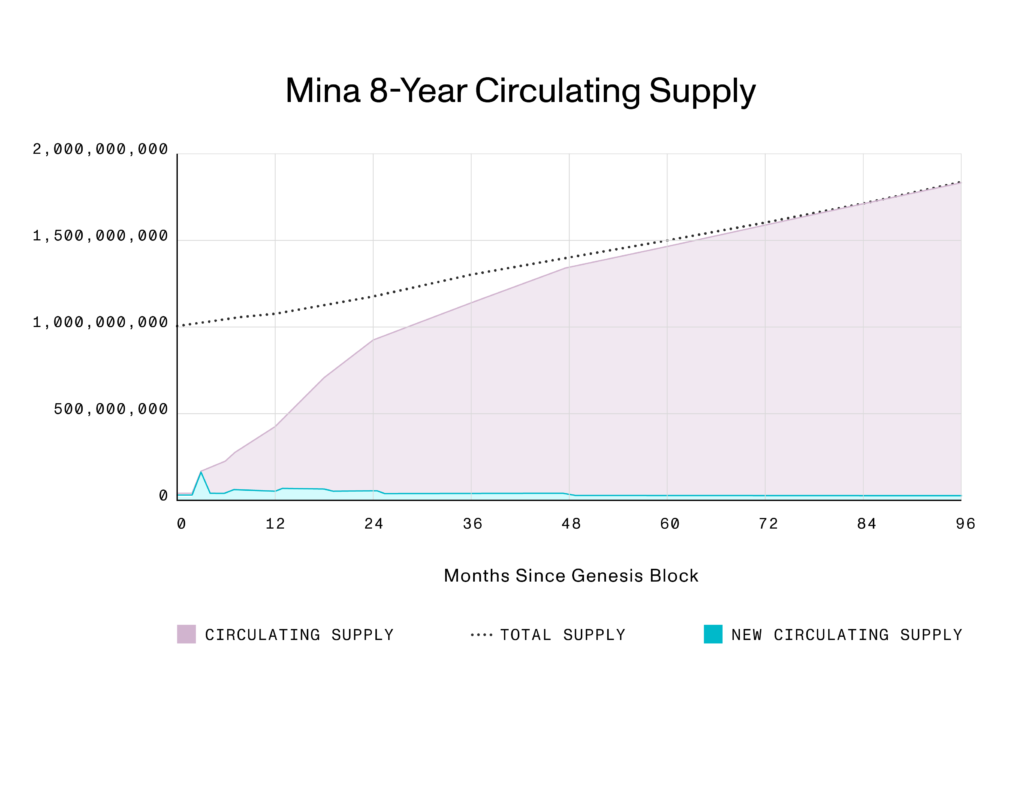

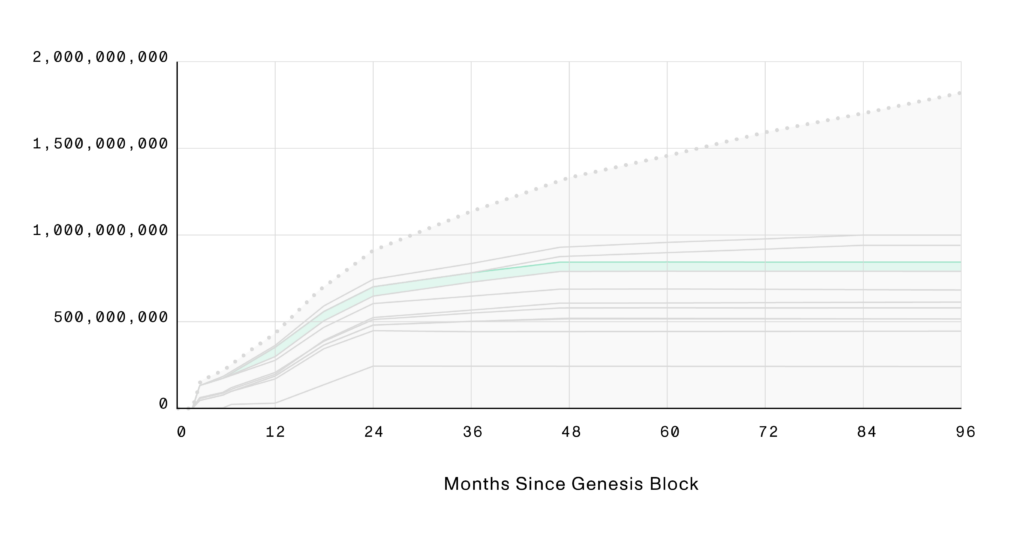

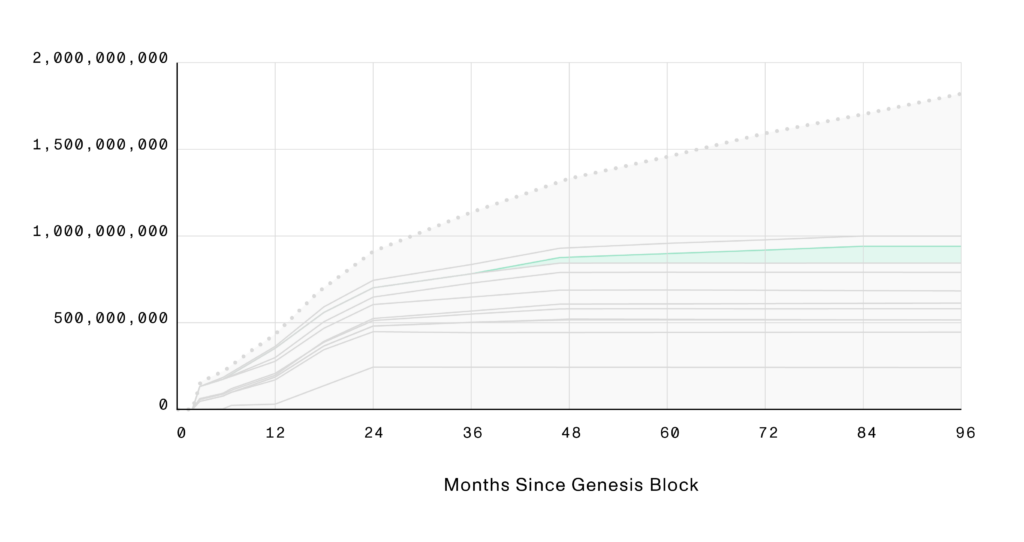

- MINA is an inflationary currency with no supply cap. All tokenholders can stake or delegate to receive their proportional fraction of the inflation, with no lockup or bonding required to do so.

- The initial distribution at the launch of Mina’s mainnet was 805,385,694 MINA tokens, subject to various lockup schedules.

- During the first year of mainnet, accounts with lock-ups have received block rewards with an annual inflation of 12%. Inflation rate will decrease over time, eventually reaching 7% at steady-state (see “Inflation” for more details).

- During the first 15 months of mainnet, unlocked accounts (excluding O(1) Labs and Mina Foundation) have received double the block rewards that locked accounts received (see “Supercharged Rewards” for more details). This incentivizes participants new to the network and unlocked token holders to stay loyal to the ecosystem.

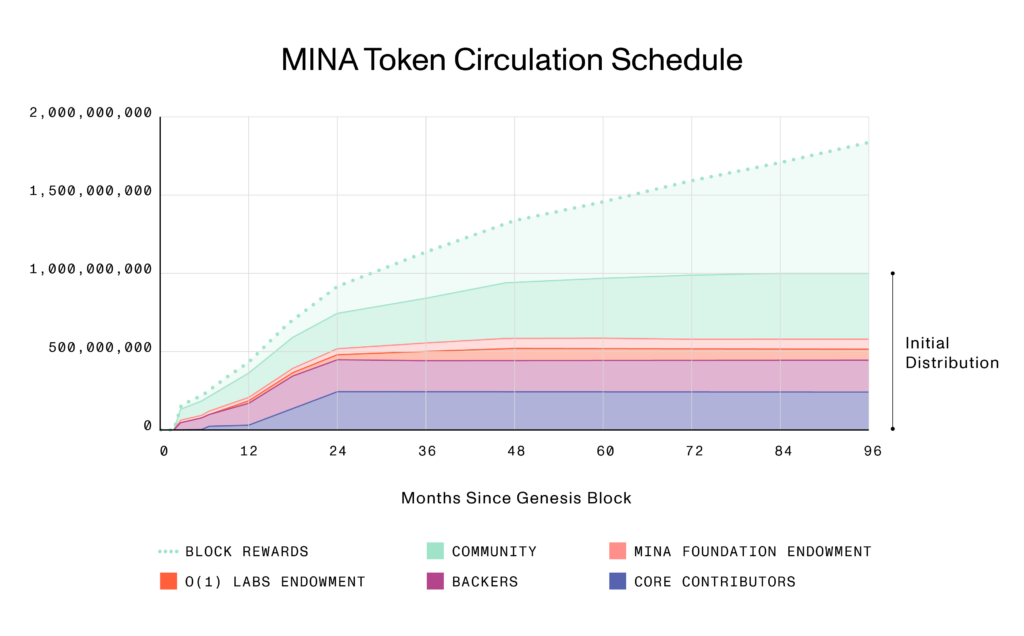

- A forward-looking 8-year chart of the entire distribution schedule is available here:

Sections

- Definitions

- Initial Distribution

- Inflation

- Initial Distribution Categories

- Initial Supply

- Circulating Supply vs Staking Supply

- Conclusion

Definitions

Genesis Block: The first block of the Mina blockchain. Includes all the MINA tokens that are a part of the Initial Supply. Tokens are deposited to the Mina addresses of their intended recipients as of this block.

MINA token: The native currency of the Mina blockchain. MINA tokens are required to stake and produce blocks on the Mina blockchain. They’re also the exclusive currency of the Snarketplace, which is used by block producers and SNARK producers to buy and sell SNARK proofs. Each MINA token is divisible up to 9 decimal places.

Mina Foundation (MF): Mina Foundation is a public benefit corporation that is incorporated in the state of Delaware. It supports the Mina ecosystem, and its primary role is to issue grants to third parties. More on the Mina Foundation can be found here.

O(1) Labs: O(1) Labs is a San Francisco based startup that incubated Mina. O(1) Labs’ mission is to use cryptography and cryptocurrency to build computing systems that put people back in control of their digital lives. It continues to contribute to the project via code contributions and operational support. More on O(1) Labs can be found here.

Staking and Delegating: Mina is a Proof-of-Stake based blockchain. As such, the right to become a block producer on the network is earned by staking MINA tokens. Holders of MINA tokens can also choose to delegate their tokens to another block producer, for them to stake. As opposed to some other Proof-of-Stake based blockchains, staking in MINA doesn’t have slashing or bonding periods. More on Mina’s staking dynamics can be found here. Those interested can also read more about tokenomics simulations for various attack scenarios here.

Lock-ups and Unlocking: The vast majority of tokens in the Initial Supply were subject to lock-ups. Tokens held by the Mina Foundation and O(1) Labs Endowments are subject to lockups, and both entities are committed to adhere to the unlock schedules in their respective sections below. Locked up tokens cannot be transferred out of their accounts, but can be staked or delegated.

Initial Distribution

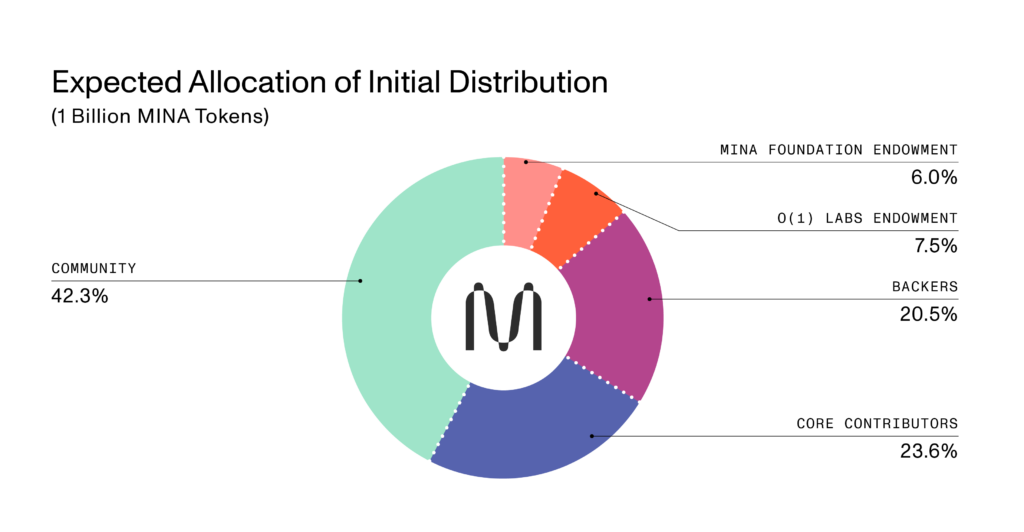

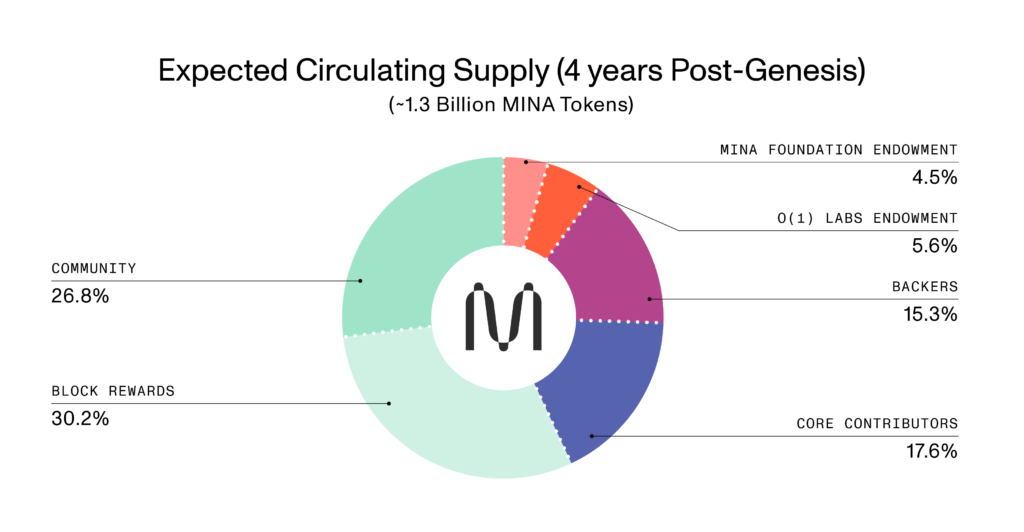

The Initial Distribution of MINA was 805,385,694 tokens. This number includes all of the categories of token recipients in the distribution schedule, except for block rewards, which are minted anew by the protocol with each block after its launch.

Inflation

MINA is an inflationary currency with no supply cap. This decision was made in order to incentivize a high level of staking participation in the early years of the protocol, which will increase the level of decentralization. Mina’s “Supercharged Rewards” (discussed in a later section) also achieve this objective. Since staking is open to all tokens on the protocol (without the risk of bonding or slashing), any token holder is able to avoid getting diluted by staking or delegating.

Ongoing inflation is generated via block rewards, which get paid to block producers via each successful block’s coinbase transaction. At the outset, Mina Foundation had proposed the below block reward schedule and inflation targets for the minting of MINA tokens beyond the Initial Distribution:

On January 1, 2023, the MIP 1, which was proposed by our community member garethdavies#4963, was passed by the Mina community. This means that at the next available hardfork, Supercharged Rewards will be removed. We thank everyone who participated in the MIP 1 decision.

1 At the mainnet launch of Mina, block rewards were fixed per account to the target inflation rate. Please note that 12% inflation assumes that all 100% of tokens owned by a tokenholder were staked or delegated.

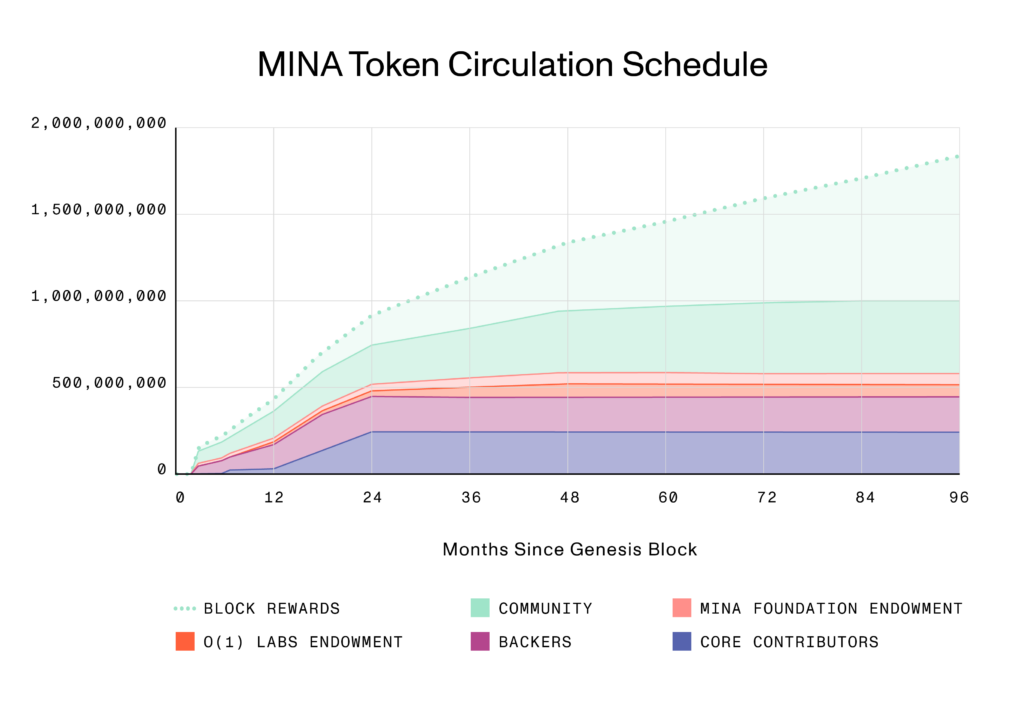

Initial Distribution Categories

1. Community Distribution (42.3% of Initial Distribution)

1.a) Pre-Mainnet Genesis Members (4.4% of Initial Distribution)

As the world’s lightest blockchain, powered by participants, Mina is first and foremost a community-owned project. Starting with the first open-source release of its code, and accelerated by the launch of its public testnet in Q3 2019, Mina has been supported and enriched by thousands of contributors.

The most committed and qualified of these contributors came together to form the Genesis Program. The Genesis Program prepared participants to become Mina’s first block producers in order to achieve a high level of decentralization upon mainnet launch. As well as node operators, the Genesis Program also consisted of developers and community builders with a variety of skills and backgrounds. Their contributions included building tooling and apps, creating documentation, organizing community events, and reporting critical bugs. Over 59 countries are represented and our GFMs have over 1,500 years of collective coding experience.

Genesis members were rewarded and given a responsibility via MINA token grants from Mina Foundation. Each Genesis member is entitled to receive 66,000 MINA tokens. These grants vest over 4 years, with an initial cliff 1 year after Genesis Block. These grants are required to be staked, otherwise they are forfeited. In total, 4.3% of the Initial Distribution had been allocated to 663 Genesis Members selected throughout Mina’s numerous testnets.

1.b) Community Sale (7.5% of Initial Distribution)

Please refer to “Backers – Post-Mainnet Token Sale” section for more information.

1.c) Project Grants (11.0% of Initial Distribution)

Perhaps the most important mandate of the MF is to involve a diverse and global set of contributors to improve, grow and contribute to the Mina Protocol. These projects will span a wide range, from protocol improvements to zkApps projects, and from operational contributions to community efforts. Project Grants will be under the control of the MF, and will unlock over 4 years. The MF will, at the end of each quarter, publish a transparency report that provides the public with an update on the grants the MF has made throughout the year, among other things.

Many zkApps are being built on the Mina protocol at this moment. Please refer here for examples of different zkApp projects that are being built on the Mina Protocol.

1.d) Supercharged Rewards (4.6% of Initial Distribution)

Although the majority of the Initial Distribution unlocks over time, some portions do not. In order to foster a high staking ratio and orderly markets, Mina Protocol had been designed to provide extra block rewards (i.e., Supercharged Rewards) to block producers that stake with unlocked tokens until such time as the community votes to remove them. Mechanically, the Mina Protocol paid out extra block rewards via coinbase transactions.

Supercharged rewards were not a step function, but a constant block reward that linearly interpolated over each time period. For example, if the Supercharged Yield Target is set to 18% in a hard fork, the actual yield will be <18% by the end of the period (such that the average for the entire period is interpolated to be 18%.

Supercharged Rewards did not exist at the Genesis Block, and were minted by the protocol itself, according to the below ruleset. As a result, Supercharged Rewards were not a part of Initial Supply, but were described as part of Initial Distribution.

1[Changes in the Supercharged Yield Target are dependent on network-approved hard forks, and are thus dependent on the timing of those hard forks. On January 1, 2023, the Mina community voted, through the MIP process, to remove the Supercharged Rewards from the protocol. Such change requires a hard fork, and it is anticipated that such hard fork shall be led (and implemented) by Mina’s ecosystem partners. Once such hardfork occurs, the rate of supercharged rewards will decrease.

2Inclusive of yield/inflation from Normal Block Rewards; note that these targets are an interpolated average over the period, such that the actual yields earned at the beginning and end of the periods will be higher and lower respectively.

1.e) Post-Mainnet Genesis Members (8.8% of Initial Distribution)

At the time this article was initially written, the Post-Mainnet Genesis Program was intended to be a continuation of the Pre-Mainnet Genesis Member Program. The Post-mainnet Genesis Program’s goals were to reward and prepare the most qualified members of the community to become active stakeholders of the Mina protocol. This Program, however, has not launched, and whether it will be launched will be decided by the Mina community through the MIP process.

1.f) SNARK Mining (6.0% of Initial Distribution)

A big part of Mina is SNARK production. In Mina, while block producers provide security for the network and allow it to reach consensus, SNARK producers keep the blockchain at a fixed size. Block producers need to work with SNARK producers to make sure every transaction gets SNARKed.

SNARK producers end up selling the SNARK proofs they produce to block producers. Although this incentivization is helpful to sustain some SNARK production capacity, there will be times where demand for SNARK proofs will surpass available supply.

At a future date to be decided, we expect there to be a community-driven MIP to determine whether SNARK producers should be subsidized via a mechanism called SNARK mining.

2) Mina Foundation Endowment (6.0% of Initial Distribution)

The Mina Foundation (MF) is fully independent of O(1) Labs and supports the Mina ecosystem, founded by a diverse group of industry leaders. It has proposed the Genesis Block and coordinated the initiation of first block producers on the network. Beyond the network’s launch, the MF carries out its mission to support a vibrant, decentralized network and currency powered by participants by supporting initiatives to decentralize and improve the protocol via grants and open-source projects.

20% of the MF Endowment was unlocked at launch. The remainder of the endowment unlocks continuously over 3.5 years and started 6 months after launch. All of the locked and unlocked tokens constituting MF Endowment has been delegated to third-party block producers in accordance with MF’s Delegation Program. MF has published transparency reports on a quarterly basis, disclosing, among other things, the latest status report on MF asset snapshots, treasury management and grant spend in the applicable quarter. Transparency reports can be found here.

3) O(1) Labs Endowment (7.5% of Initial Distribution)

O(1) Labs will continue to contribute to Mina, with a focus on developing tooling for zkApp developers. As such it is important that it can attract future talent with the right incentives, a big part of which is grants in MINA tokens. O(1) Labs Endowment enables O(1) Labs to grow its team and continue investing more into the Mina protocol. It unlocks over 4 years from mainnet launch.

Because this blog is authored by MF, continuing information relating to O(1) Labs Endowment is outside of the scope of this blog.

4) Backers (20.5% of Initial Distribution)

Mina is built by a team of world class engineers, cryptographers and operators. Mina has been incubated by O(1) Labs, LLC, a San Francisco based Delaware, USA partnership. In order to fund Mina’s incubation, O(1) Labs, LLC has raised funding from a total of 46 well-known institutional and long-term oriented backers. A list of notable backers can be found on the project’s website. Per O(1) Labs, LLC’s constitutive documents, each unitholder in the LLC, including backers, received a pro-rata share of MINA tokens, as of the Genesis Block. In order to foster decentralization, O(1) Labs picked its backers such that no single one held more than 3.3% of the Initial Distribution, and only 7 had more than 1%.

The total share of MINA tokens allocated to such backers was 20.52% of the Initial Distribution. These tokens unlocked over 18 months from launch, with no single Backer having unlocked their entire allocation at launch. In addition, all tokens allocated to Backers were fully locked until 40 days after the Community Sale, such that Backer tokens only received the first tranche of their unlocked tokens once Community Sale tokens started unlocking.

Pre-Mainnet Token Sale History

Prior to the launch of mainnet, O(1) Labs, LLC raised funding at various implied prices per MINA token. A full pre-mainnet fundraising history can be found below.

Post-Mainnet Token Sale History

Mina Foundation, a non-stock corporation incorporated in the state of Delaware, is led by Evan Shapiro (CEO) and managed by board members who are industry leaders. The majority of such board members are independent (defined as individuals that are not affiliated with Mina Foundation or any of its ecosystem partners).

In April 2021 – one month after the launch of mainnet – Mina Foundation conducted a token sale of 7.5% of the Initial Distribution through Coinlist to non-US persons only, subject to certain lock-up periods (“Community Sale”). At the time these Community Sale tokens unlocked, they constituted the super majority of liquid tokens circulating at that time.

Between February 2022 – March 2022, the Mina ecosystem has raised $92 million from strategic and institutional backers of the ecosystem. Because post-mainnet token sales occurred after the Genesis Block, the charts noted throughout this blog have not incorporated their transition from “MF Endowment” to “Backers.”

5) Core Contributors (23.6% of Initial Distribution)

Core contributors consist of O(1) Labs and its advisors that have enabled the successful launch of mainnet. Founded in 2017 by Evan Shapiro (who later moved on to become CEO of Mina Foundation) and Izaak Meckler (who later assumed an advisor role to O(1) Labs), Evan and Izaak put together a world-class team of engineers, cryptographers and operators. This team that incubated O(1) Labs had consisted of approximately 30 full-time employees and was a core contributor to the protocol over 3 years prior to the launch of mainnet. Post mainnet launch, the O(1) Labs team continues to be an important ecosystem partner, as they work to optimize the protocol and provide tooling for zkApp developers.

Each core contributor has grants made available to them, which vest over 4 years, with an initial cliff 1 year after their starting date at O(1) Labs. In addition to their vesting schedule, each team member has also agreed to an unlock schedule for their vested tokens that stretches out over 2 years from mainnet launch.

6) Block Rewards

Block rewards are awarded to all network participants who stake or delegate their tokens. These rewards are paid to stakers or delegators at the target rate described in the “Inflation” section above.

Since these block rewards are available to everyone, and since all token-holders are able to stake or delegate without the risk of slashing or bonding periods, we consider these block rewards to be an integral way of distributing tokens to Mina community members.

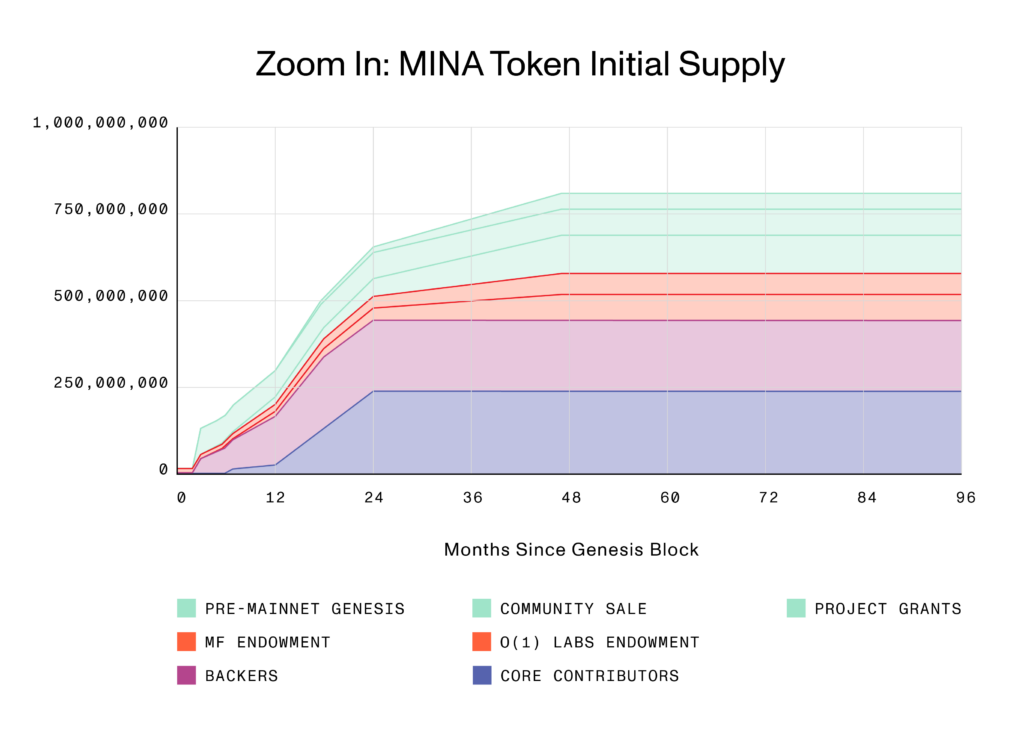

Initial Supply

The subset of the Initial Distribution that is included in the Genesis Block is called the Initial Supply. The Initial Supply consists of the majority of categories described above. The subset of categories that were not available in the Genesis Block are “Post-Mainnet Genesis Members”, “SNARK Mining”, “Supercharged Rewards”, and “Block Rewards”.

In order to maximize decentralization, the Mina Foundation decided not to include these categories in the Genesis Block, and instead these are minted over time. In the case of “Post-Mainnet Genesis Rewards” and “Snark Mining”, the Mina community shall decide, through the MIP process, whether such programs are in the best interest of token holders. In the case of “Supercharged Rewards” and “Block Rewards”, this logic is already included in the mainnet launch version of Mina, and “Supercharged Rewards” started getting distributions from the Genesis Block onwards. More on the mechanics of each of these categories can be found in their respective sections under the Initial Distribution Categories section.

All other categories of the Initial Distribution will be available and created as of the Genesis Block, and are collectively called the Initial Supply. The Initial Distribution of MINA is 805,385,694 MINA tokens. Initial Supply includes the categories of “Mina Foundation Endowment”, “Backers”, “Pre-Mainnet Genesis Members”, “Core Contributors”, “O(1) Labs Endowment”, “Community Sale”, and “Project Grants”. Recipients with allocations of tokens under each category will receive their balances to addresses they submit to the Mina Foundation prior to the minting of the Genesis Block. More on the mechanics of each category can be found in their respective sections above.

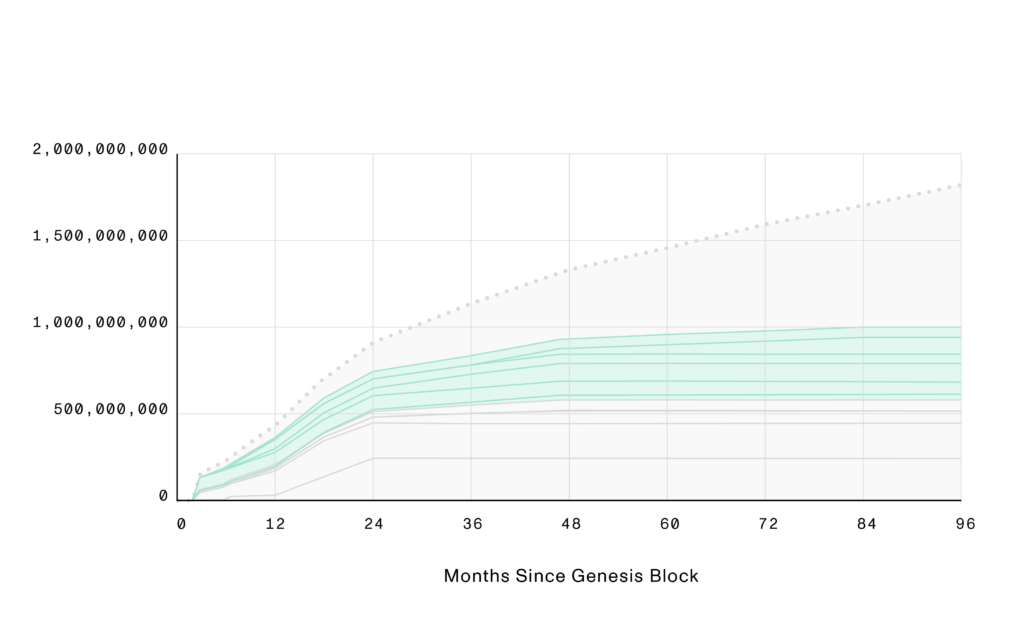

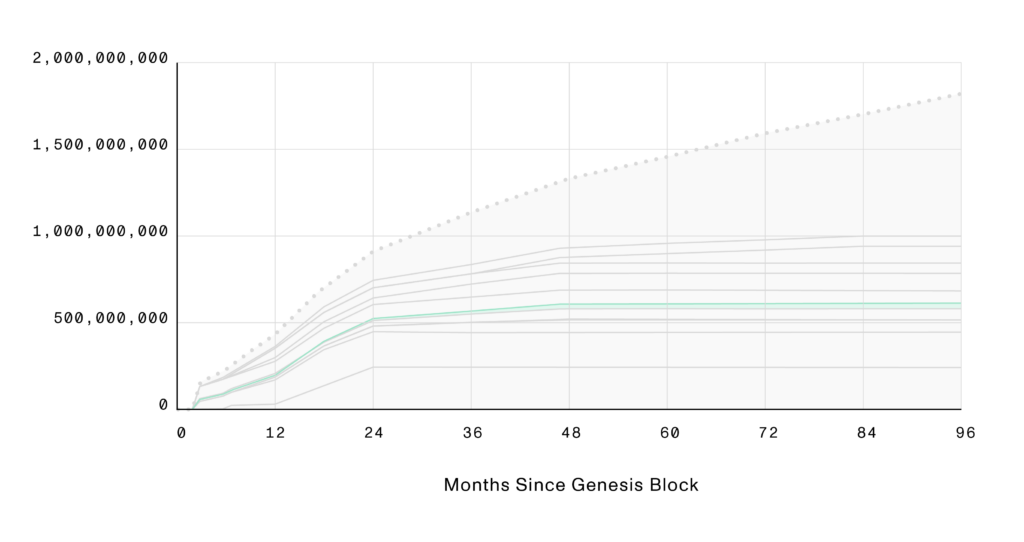

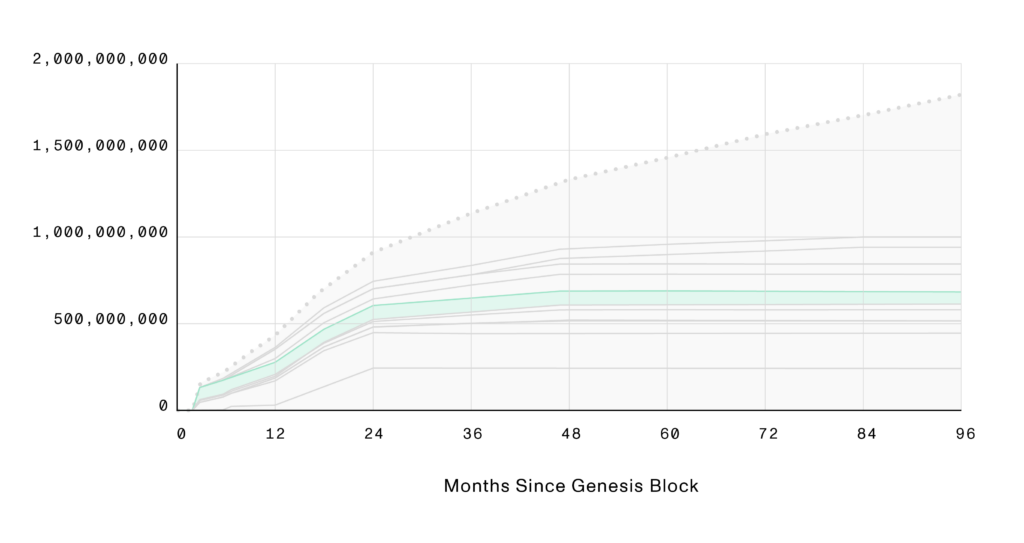

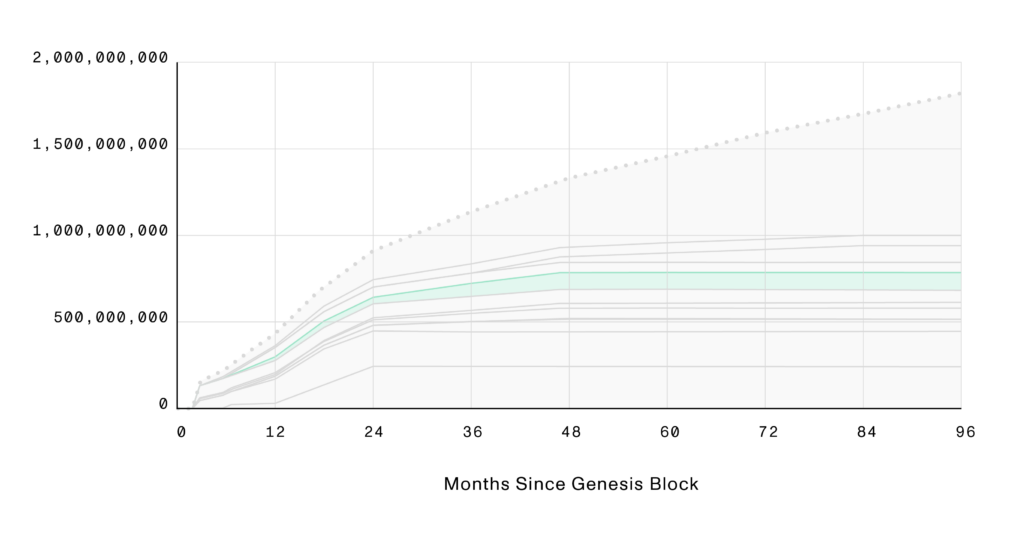

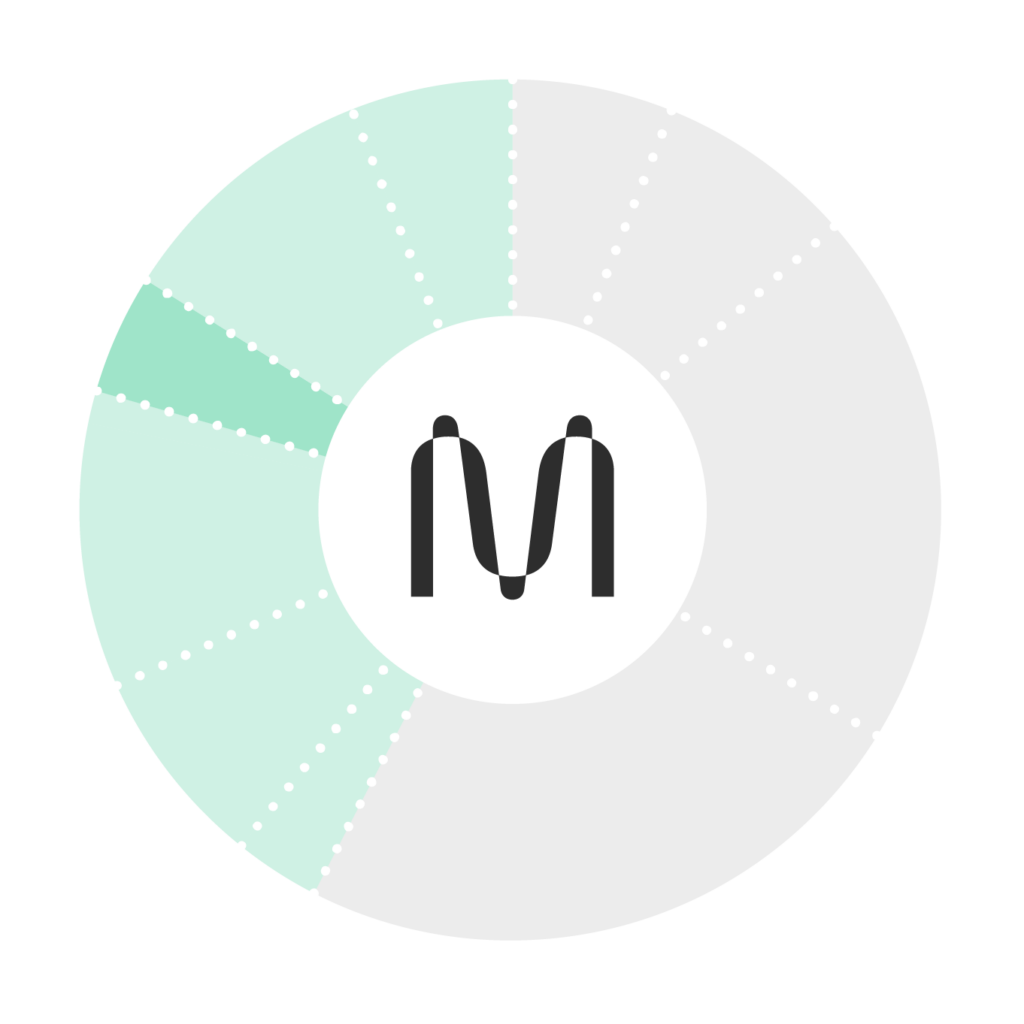

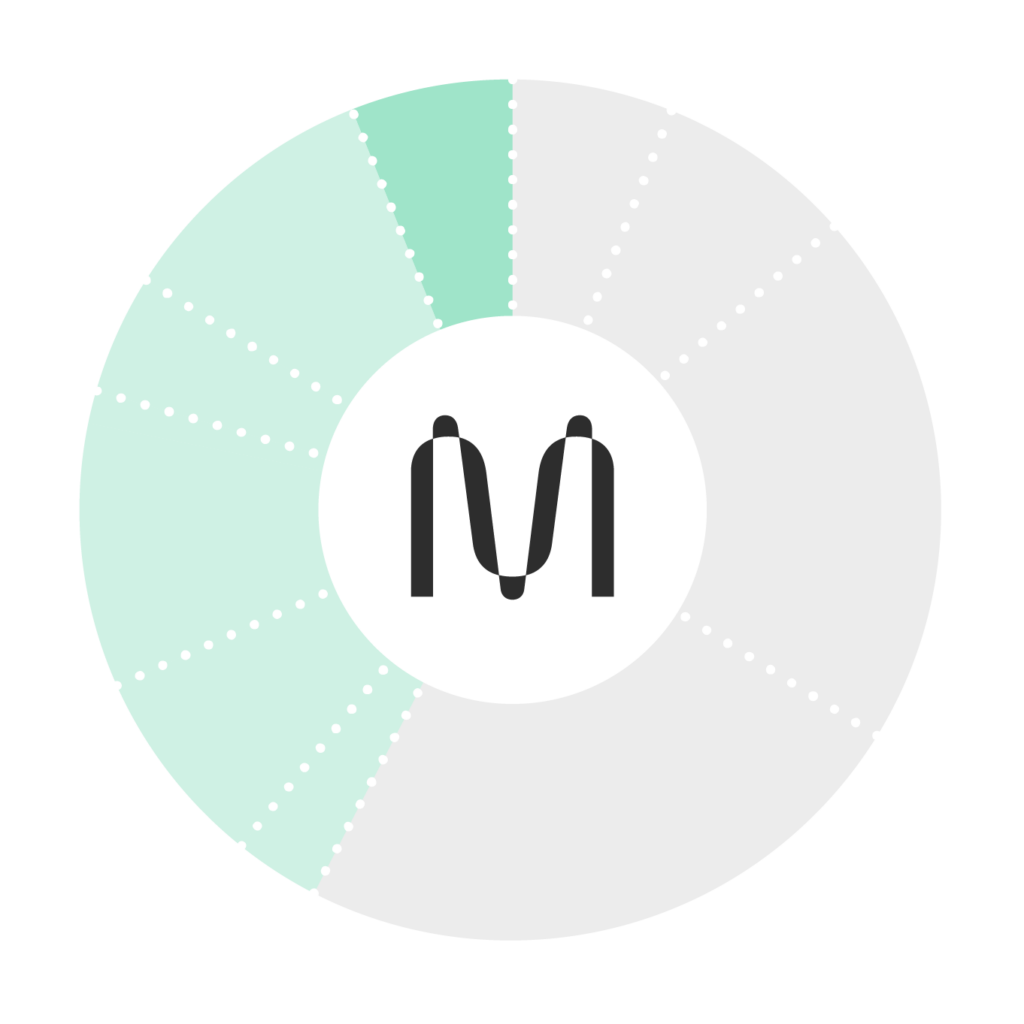

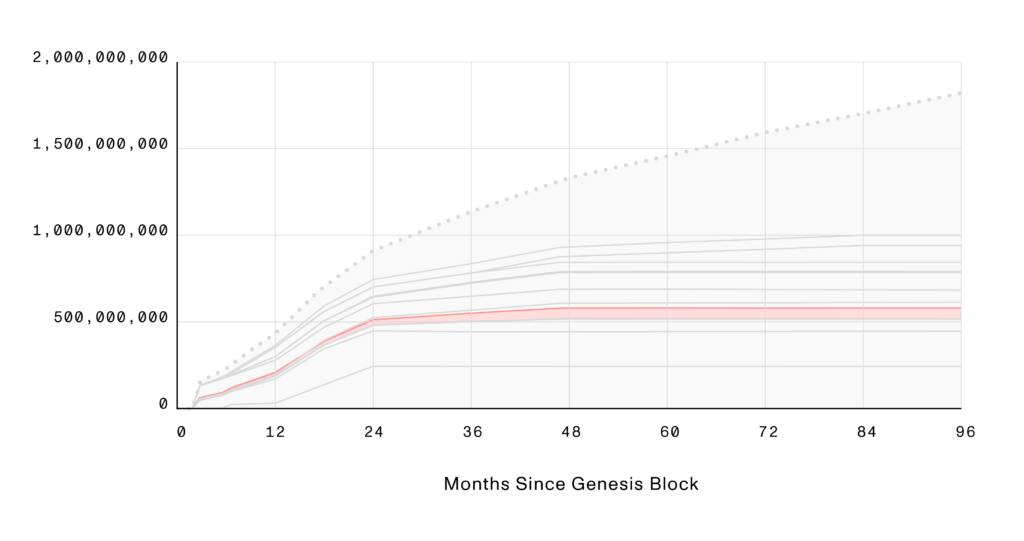

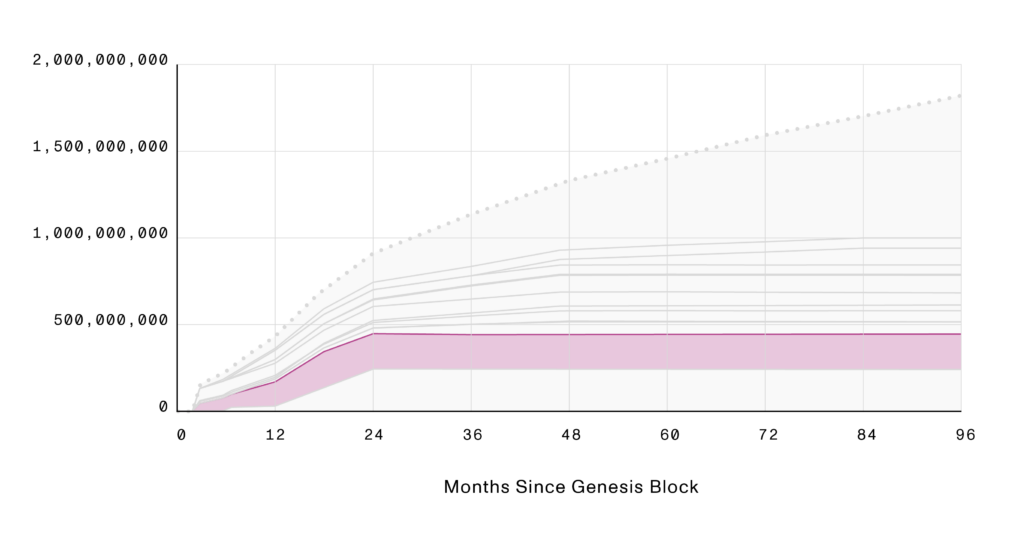

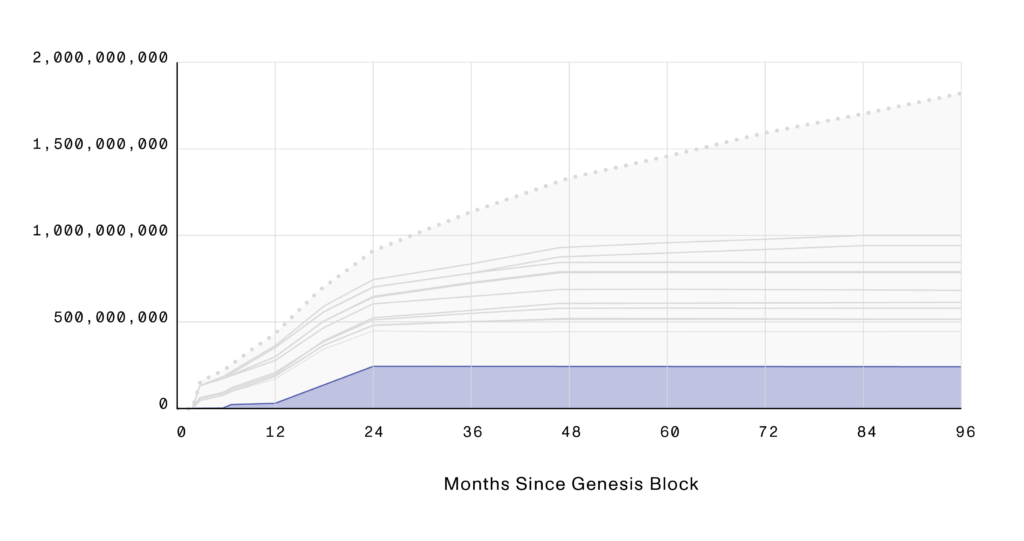

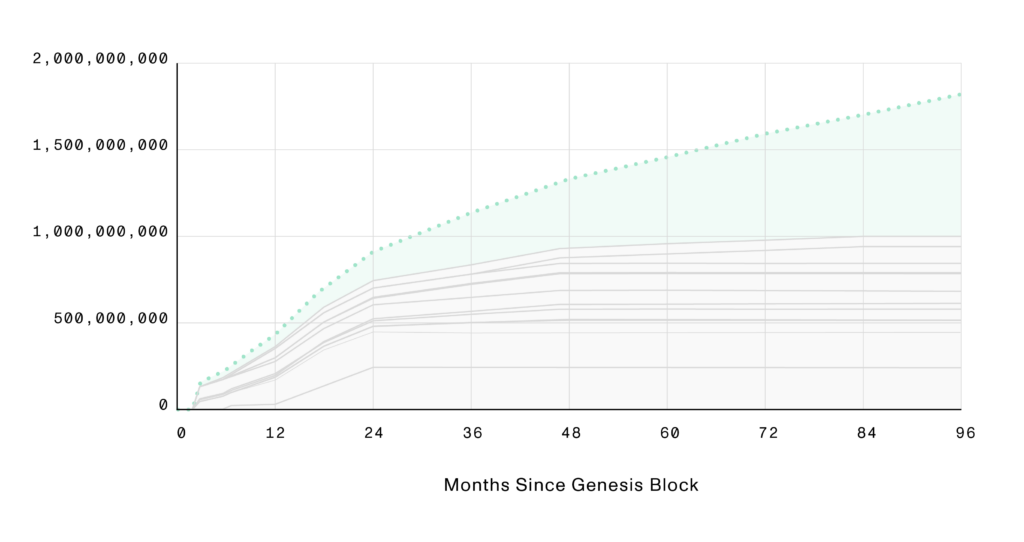

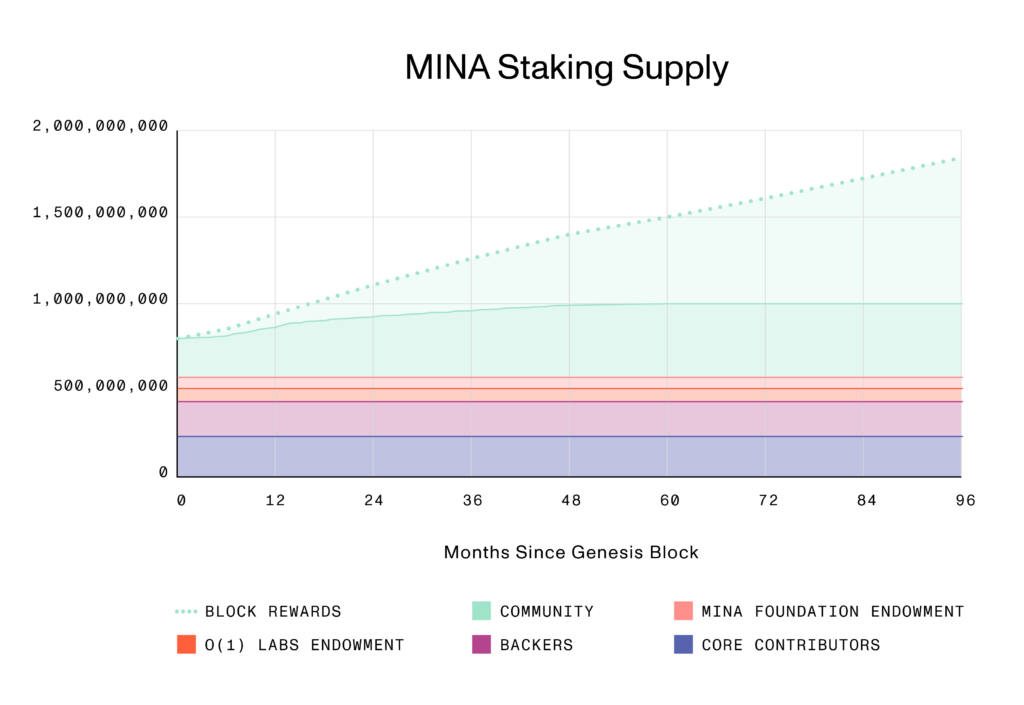

Circulating Supply vs Staking Supply

Circulating Supply is what is represented in all of the charts up until now. Due to the majority of MINA tokens being locked, the Circulating Supply of MINA starts off small, and increases over time. Circulating Supply increases in three ways: 1) when tokens are unlocked; 2) when block rewards are minted, creating new tokens; and 3) when new distribution categories are proposed and adopted via hard forks.

In contrast, Staking Supply represents all tokens that are in existence (both locked and unlocked). All MINA tokens that exist are eligible for staking, no matter their lock status. As a result, Staking Supply increases only with block rewards and other freshly minted tokens.

Summary

Mina is the world’s lightest blockchain, powered by participants. Its use of zero-knowledge proofs and other cutting-edge technology allows users to always stay in control, no matter how large and powerful the blockchain becomes. And it enables powerful and novel zkApps use cases. Since the launch of mainnet, Mina has grown to become one of the largest and most engaged communities in the crypto industry. With this post, the Mina Foundation has created a transparent resource to inform the community about the distribution of MINA tokens.

MF seeks to achieve transparency in its operations to community members. While an important player in the ecosystem, MF is one of now many ecosystem partners that are contributing to the betterment of the protocol.

The most important player in the ecosystem is YOU – the developer. There are many ways to get involved, so join us in our community hub and check out http://minaprotocol.com/community or http://minaprotocol.com/get-started to have your say in the project. Our ears are wide open.

Finally, if you detect any errors or inconsistencies with any of the data provided, please reach out to us on the general channel on the Mina Discord. There’s tons of data and complex models behind the Mina distribution, so help us make it as accurate as possible!

In creating this guide, we have been guided by the level of detail and transparency other blockchain projects before us have shown with their own token distribution schedules. In particular, we would like to recognize the NEAR Foundation for putting together an exemplary guide, which inspired a good amount of the content and structure in this post.

Disclaimer: Information provided herein includes estimates as of the date of publication and their accuracy is not guaranteed. Neither O(1) Labs nor MF makes any representation that any data provided herein will remain unchanged when mainnet launches. Statements may be forward-looking and are not intended as guarantees of future performance.